Loanch is a P2P investment platform which inherits the best of the functionality and accessibility of the main traditional Baltic platforms, focusing on short-term consumer loans and very high profitability, a combination that is always appreciated. In addition, it has the unique trait of its country of origin, Hungary, being the first platform from this nation that we bring to this blog and with the particularity of being focused on loans and operations in the Asian market exclusively…

So… Do you want to know ALL our opinions as users of it?… well… Don’t miss our super review!

Loanch Review – Critical Performance Parameters Opinion and Analysis – Hexastar Chart

RETURN: Loanch begins its journey in the arena of crowd investments with a more than attractive profitability, with returns close to 14% in many of its operations and specific promotional campaigns, cashback, etc. that can increase profitability to become one of the most competitive on the market at this time.

GUARANTEES: All operations on Loanch have a total Buyback (capital and accrued interest) after 30 days -compared to the 60 days that most platforms in the sector have-. Its originators have been established in their respective countries for several years and are one of the most prominent lending companies in the sector nationwide.

DIVERSIFICATION: Despite not having as many Originators as other existing marketplaces, in Loanch we find two differentiating factors that add points in this category: first, its focus on infrequent countries that are difficult to access for European investors such as Malaysia, Indonesia and Sri Lanka, and the second, the company’s own headquarters, Hungary that distances itself from the barrage of Baltic platforms – and more recently – the new fashion of Croatians and Irish.

LIQUIDITY: With a clear focus on the short term and numerous investment options with a term of just one or two months, Loanch undoubtedly stands out in this section despite not yet having a secondary market function.

FUNCTIONALITY: Original and easy-to-navigate interface, autoinvest and investments from just 10 euros. There are many differentiating virtues that Loanch has from the very first minute compared to other first-time platforms, good job!

CUSTOMER SERVICE: Without too many opinions in the different opinion aggregators yet, our experience and direct contact with Loanch staff have been especially positive, with a great quality of service, proactivity in improving the experience and transparency and professionalism in all communications.

Is Loanch Safe or Not – Due Diligence Findings

*Loanch.com is the website of the company Risetech Kft., with registration number 01 09 409513, VAT number 32156959-2-42 and registered office in Budapest, Szervita Square 8, Hungary.

*The share capital with which the company was established is 3,000,000 Hungarian forints, about 8,000 euros, which is above the average for recently created platforms.

*In the company registry, within activities, it appears under heading 6619: Other auxiliary financial functions, which is consistent as a P2P marketplace.

*The head and CEO of Loanch is Nik Sinickis with a verified profile on professional social networks such as LinkedIN

* With the information collected, there is no a priori reason to think that loanch.app is a scam.

Loanch Tutorial – How to Get Started Step by Step

Loanch follows a similar process to other P2P platforms when creating an account and starting to invest. It is a very quick and simple process – one of the simplest that we have found recently, which is always appreciated – and we will basically have to follow the following steps:

- Register by clicking on the SIGN UP button and fill out the simple initial form.

- Confirm the email that we will receive in our inbox by clicking on it.

- Complete the KYC process, similar to other platforms in which we will be asked to have our ID or passport on hand, take a selfie, etc. In this case we will do the process with Veriff, one of the undisputed leaders in the sector -and one of the ones that works best-

- Wait for the validation of our data (in our experience this step is practically instantaneous, in a few minutes we will be able to access all the functions of the platform).

- Make the first contribution of funds via bank transfer with the information that will be indicated in our Loanch account.

How to Invest in Loanch – Options and Considerations

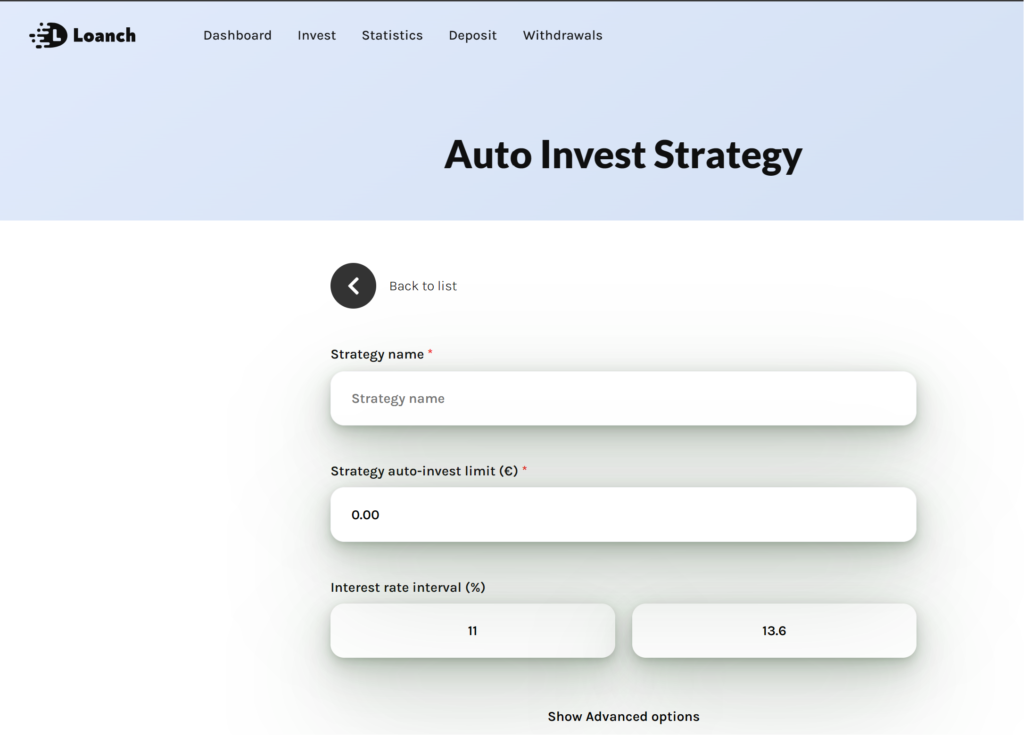

In Loanch we can invest MANUALLY from 10 euros per operation in any of the loans listed in its marketplace or use its simple AUTO-INVEST function that we can quickly configure with a few clicks. In addition, the platform has its own pre-configured strategies that we can choose at will to further simplify our investment process.

P2P Loanch Opinion Review

Advantages of Loanch – Strong Points

1) Unsurpassed baseline investment parameters, with more than 13% annual profitability, very short-term operations and total buyback in 30 days.

2) Very intuitive and easy-to-use platform, also accessible from just 10 euros per operation.

3) Geodiversification by flag, with a clear focus on a diverse Asian market and the platform’s headquarters in a different than usual country like Hungary.

Weaknesses and Aspects to take into account

1) Despite its good start and good fundamental base, we must not forget that it is a relatively recently created platform, so it remains to verify the performance of its operations in the medium and long term.

2) Although we do not consider it a priority due to the short-term nature of many of its operations, we must take into account that at the moment it does not have a secondary market.

Loanch Forum

Do you want to have a space to comment and share your doubts and experiences about this Hungarian P2P platform?… Look no further! Below we have enabled the Loanch Forum so you can express yourself and ask questions freely… Write us your comment!