Zlty Melon is a different crowdlending platform in many ways. For starters, it is the only Peer-to-Peer Lending website based in Slovakia, operational since 2012 , with a fresh and original interface and a selection of investment products ranging from high-yield / high-risk P2P loans to loans with mortgage guarantee.

And is that … who said that all the European crowdlending is in the hands of the Latvian, Estonian and Lithuanian platforms? … Do not miss this MEGAReview because we are going to show you how the Yellow Melon (Zlty Melon) refutes this argument! 🙂

What is Zlty Melon Statistics and Global Data

Zlty Melon is a platform that has been around for more than five years, offering all European investors the possibility to participate in loans between individuals from Slovakia and the Czech Republic.

Throughout all this time, it has won the trust of thousands of satisfied investors and has financed operations worth more than 10 million euros of accumulated volume.

Its average historical profitability is around 15%, with a delinquency rate between 4 and 5%, which makes it present a net return of around 10% before commissions.

First Steps in Žltý Melón

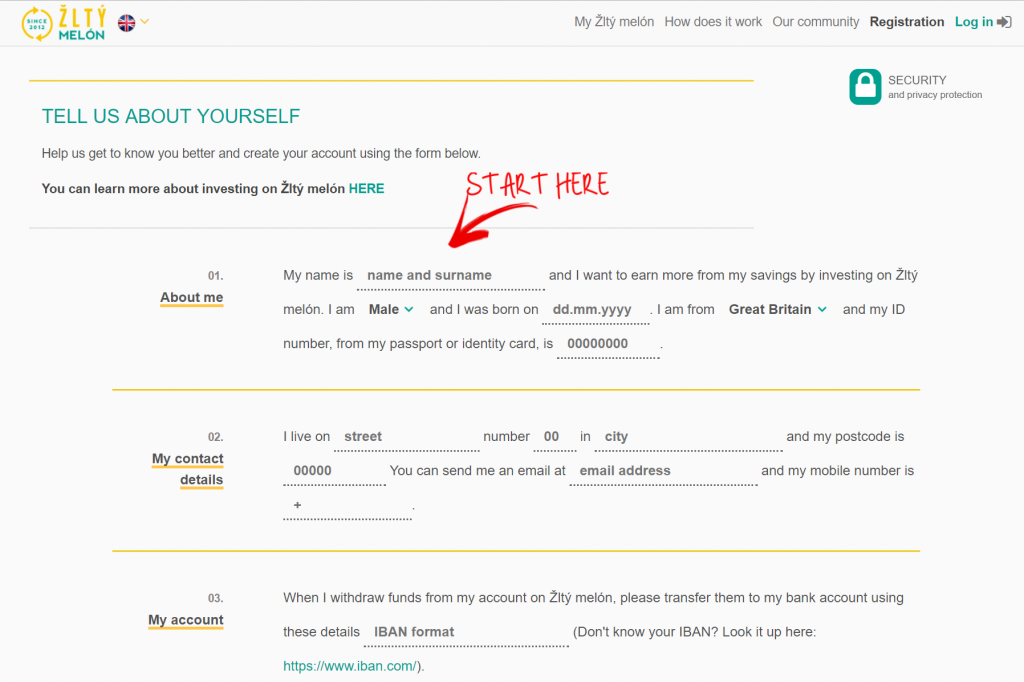

The registration in this Slovak crowdlending platform is very similar to the procedure followed by the other European platforms . There are not many surprises here: we will have to fill out the typical initial questionnaire, confirm our email, provide identity documentation and make a first transfer.

Requirements to create an investor account in Zly Melon

+ Be of legal age (over 18 years).

+ Have a bank account in a country of the European Union.

Steps to Open an Account at Zlty Melon Crowdlending

➊ Fill in the initial registration form.

➋ Upload DNI / Passport (identity verification document) + Copy of the Zlty Melon framework contract signed

➌ Wait for the verification by the legal team of Ztly Melon (24/48 working hours)

➍ Make the first contribution of funds to the bank account indicated to us (Zlty Melon works with the Czech bank with a European license FIO BANKA).

Deposits How to add funds to our Zty Melon account

In Zlty Melon we can make deposits in both euros and Czech crowns by bank transfer to the corresponding account indicated to us by Fio Banka (Czech online bank with which this platform works).

It is important to include in the transfer the concept or purpose of payment indicated by the platform so that the funds are allocated without delay to our account. Normally within a period of one or two business days we will see the balance reflected in our investor account.

Zlty Melon Cashback – Promo Code

Zlty Melon does NOT currently have any welcome promotions for new users, but DO have periodic CASHBACK promotions of up to 2% for existing users who invest in the so-called Cash Free Loans (as we will see later, the loans with mortgage guarantees ).

If at any time this platform offers a bonus for registering, we will immediately reflect it in this section so that you do not miss any opportunity to increase your performance.

How Zlty Melon Works Commissions

Zlty Melon charges a 1% commission for portfolio management in normal loans (this commission is reduced to 0.33% in the loans with mortgage guarantee -CASH FREE-) , but ONLY in the loans that are up to date , that is, does not charge commissions on delayed loans. In addition, it has a flat rate of 20 cents in each withdrawal of cash from our investor account to our bank account and a commission of 1.5% if we put loans on the secondary market for sale.

How to Invest in ZltyMelon in 2023

At Ztly Melon we have 4 main ways to invest. In the following sections we will describe each of them:

✰ Manual investment in the primary market from 25 euros per operation.

✰ Passive Investment through the selection of preconfigured automatic portfolios.

✰ Automatic Investment through the functionality of Autoinvest.

✰ Investment in the Secondary Market manually.

Manual Investment Analysis Zlty Melon – Most Important Parameters

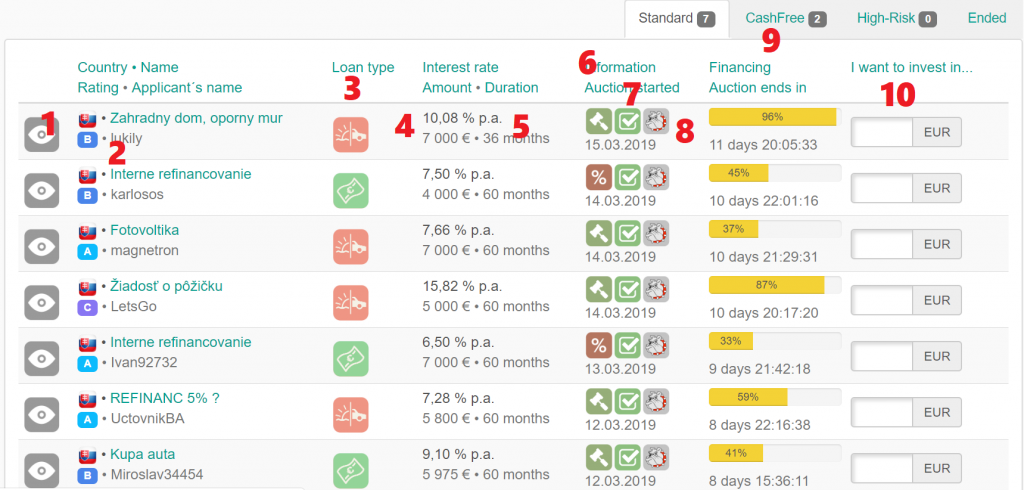

Next, we will comment on some of the most important parameters that define each of the operations published in Zlty Melón

➊ Country

In Ztly Melon, operations are published in Slovakia (usually in euros) and operations in the Czech Republic (usually in Czech crowns) . Most of the loans we will see are Slovak, which is interesting given that Slovakia is a very rare country in other crowdlending platforms, and will allow us to diversify our global portfolio by providing loans from this nation.

➋ Rating (Risk Classification)

There are a total of 9 risk classifications in Zlty Melon, and we must learn to familiarize ourselves with each of them before investing. Normally, as is logical, the higher the risk, the greater the potential profitability offered by the loans.

✰ AA -> The safest loans within the standard classification

✰ A -> Low risk loans and usually low profitability

✰ B -> Loans of medium / low risk and yield slightly higher than those of class “A”

✰ C -> Risk loans and moderate profitability

✰ D -> Risk loans and medium / high profitability

✰ D- -> High risk loans and high potential return

✰ HR -> High Risk loans, with very high profitability and very high risk (they are out of standard classification)

✰ H -> Mortgage Loans (with mortgage guarantee). Theoretically, they are even safer than AA

✰ P -> Parking Mortgage Loans: similar to H loans, but instead of a home, the collateral is a parking space.

➌ Loan Type

There are 3 fundamental types of loans in Ztly Melon, including the following categories:

✰ Standard Loans (red icon): Standard P2P loan for any purpose.

✰ Refinancing Loans (green icon): P2P loan for refinancing and consolidation of other loans

✰ Cash Free Loans (CASH FREE logo): Loan with mortgage guarantee, either from a home or a parking space.

➍ Interest Rate

The interest rate is the profitability offered by Zlty Melon in this particular operation. Depending on the type of loan, it may be a fixed return or a recommended return (in our bid we may ask for more or less profitability depending on the supply and demand, as we will see in point number 6).

Zlty Melon returns range from a minimum of 6% for loans with a mortgage guarantee (FREE CASH) up to 30% or more for some of the subprime loans.

➎ Duration

Term until the loan expires. Keep in mind that most operations in Ztly Melon are long-term, typically 3, 4 or 5 years, so we may not have a wide margin of maneuver in this regard.

➏ Type of Operation

In Zlty Melon there are two types of operations: Fixed Type and Auction

✰ Fixed rate (% icon): The interest rate is fixed and constant and similar for all investors participating in this operation

✰ Auction (mallet icon): The interest rate shown is the one recommended by the algorithms of the platform, but we can offer to enter the operation at a lower or higher rate (in this case with greater risk of being rejected and not participating in this loan).

➐ Verification and Guarantees

In this box you can see 3 different icons depending on the specific operation. Let’s see all the possibilities.

✰ Green tick icon: The income and identity of the borrower have been completely verified

✰ Red notebook icon: The borrower’s income could only be partially checked at the moment

✰ Blue people icon: The borrower has additional guarantees, such as guarantors, etc.

➑ Watch list

The icon of the dog next to an operation means that it meets the criteria you have defined in your profile as operations that may interest you (if you have not defined any preference, ALL will appear with the dog symbol).

At the top of our Dashboard, we can see 3 tabs that will give us access to the different types of operations in Zlty Melon, namely: STANDARD (standard P2P loans), CASHFREE (mortgage loans) and HIGH-RISK (HR loans) -high risk-).

➓ Indicate the amount to invest

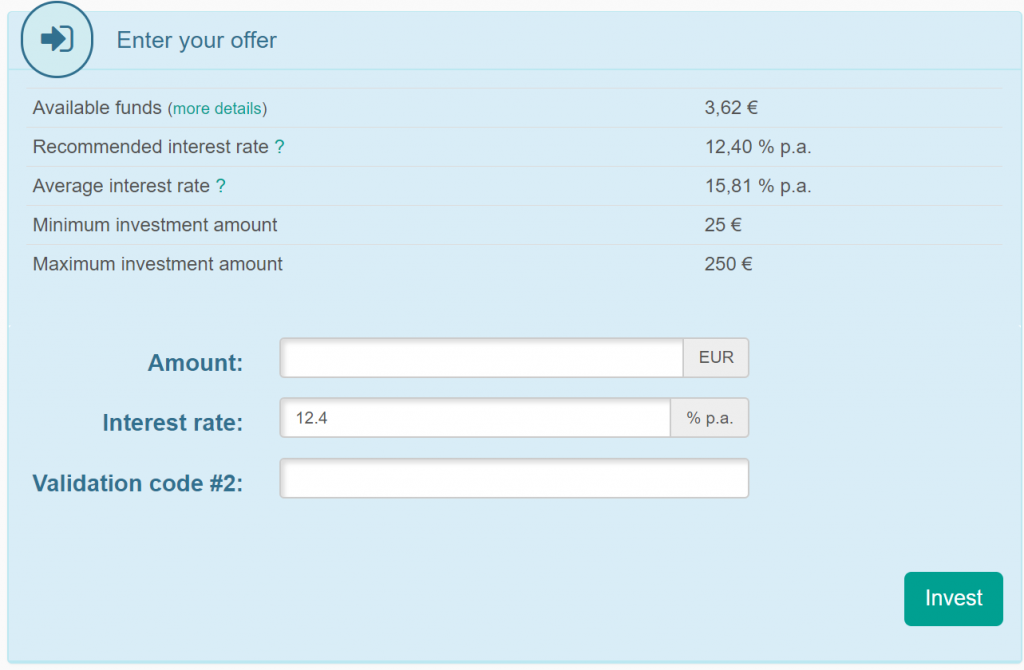

From a minimum of 25 euros per transaction, we can specify how much money we want to invest in each operation, which will take us to the following screen:

Here we will see a summary of our available funds as well as the recommended interest for this operation and the average interest that is being offered at the moment (as you can see in the example there may be discrepancies).

In this screen we will introduce the amount to be invested (from 25 euros), the interest rate that we are willing to charge and the Validation Code, from a list of personal security codes that Zlty Melon generates automatically.

We press the green INVEST button and … ready!

ZtlyMelon Passive Investment – Preconfigured Portfolios

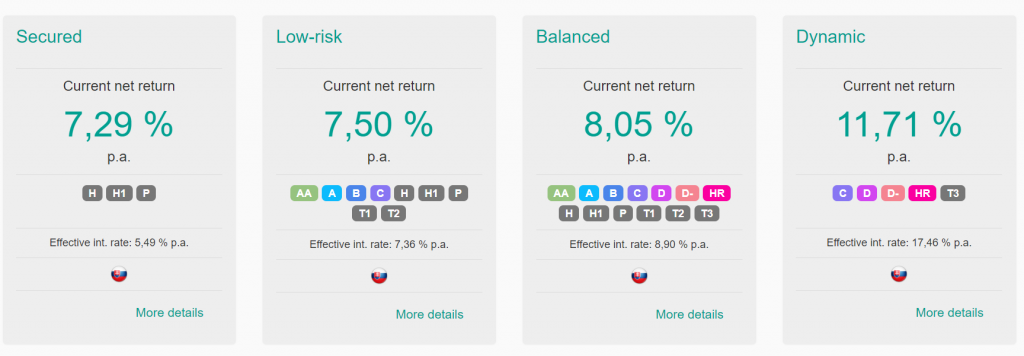

Zlty Melon puts at our disposal 4 completely automated investment strategies that will allow us to invest in a single click based on our risk profile. Specifically, these are the portfolios that it puts at our disposal:

✰ Secured: Portfolio that invests exclusively in loans with mortgage guarantees.

✰ Low-risk: Low risk, portfolio that invests only in standard C or higher loans and loans with guarantees.

✰ Balanced: Balanced portfolio, which can potentially invest in any of the platform’s operations.

✰ Dynamic: A risky portfolio that only invests in standard loans of category C or below and in high-risk loans.

Zlty Melon How Autoinvest Works (Automatic Investment) – Step by Step Tutorial and Configuration

The third option available to us in this platform is the configuration of the Autoinvest or Autoinvest tool to create our own automated investment strategy.

We are not going to stop too much at this point, but basically it works like the rest of the usual crowdlending platforms, being able to configure all the parameters in game one by one. For our taste, it presents too many configuration options, which make it a bit difficult to setup.

Žltý melon Secondary Market and Liquidity

Zlty Melon has a secondary market in which we can sell our loans or acquire the shares of other investors. For this, we must take into account the following:

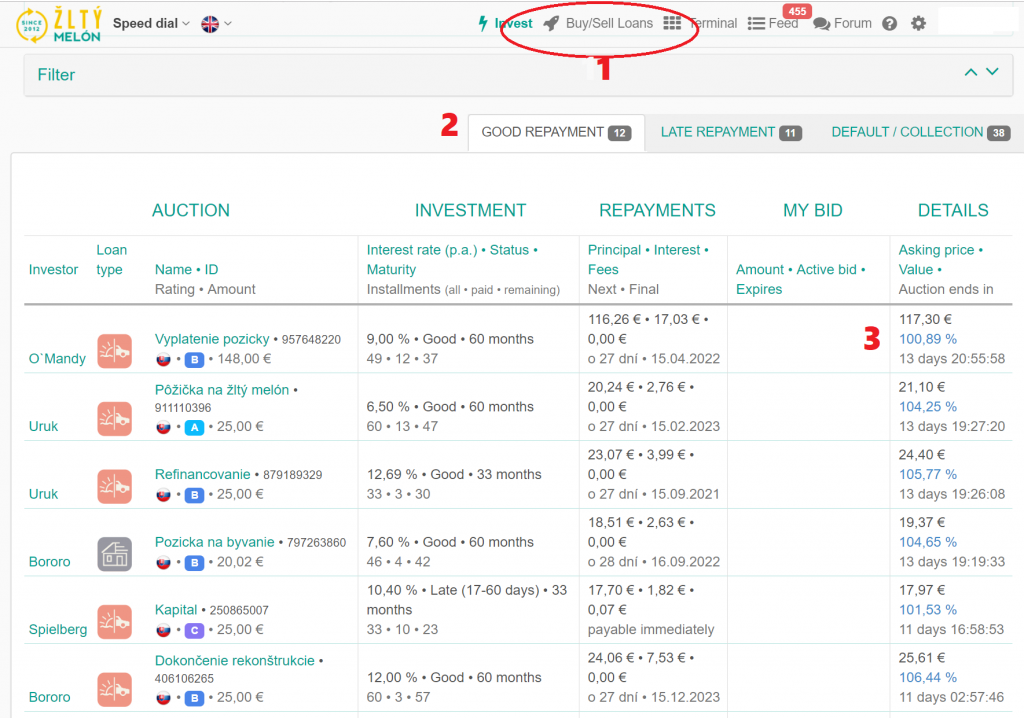

➊ Access to the Secondary Market

Zlty Melon’s secondary market is accessible through the buy / sell loans button.

➋ Typology of loans in the Secondary Market

There are 3 types of secondary loans, each accessible through its corresponding tab, namely:

✰ Good Repayment: Loans that are up to date with payments. Normally a premium will be paid on its original price.

✰ Late Repayment: Loans that are delayed according to the payment schedule, but have not yet been in default. Normally they can be purchased at a discount with respect to their original price.

✰ Default / Collection: Loans in default that may already be in the recovery phase. Normally we can buy them with a very notable discount.

➌ Percentage of the original value

Probably the most important parameter in the secondary market is this percentage that appears in blue in each operation. It is a comparative index with the original value of the loan, so that if it is 100% it has a price identical to the original purchase price.

If the percentage is greater than 100%, it means that we would be buying that operation with premium (that is, paying a supplement with respect to its original value). If the percentage is less than 100% it means that we would be buying that operation at a discount (usual case in the delayed loans or the operations in default).

Zlty Melon Buyback Repurchase Guarantee

Zlty Melon is a P2P platform for private loans, and like most websites in this category, N O offers a repurchase guarantee in the sense we are used to with Mintos, Grupeer, etc.

As a novelty, it does , however , present loans between individuals with mortgage collateral (the so-called CASH-FREE) in which there is a real estate property that is offered for sale in case of default to recover the capital, ordinary interests and interest delay if any.

Loan Originators Zlty Melon Crowfunding

Ztly Melón puts directly in contact people who need financing with investors who want to get a return on their savings. There are no intermediary credit institutions in this platform or any type of Guarantees associated with Originators, etc.

Zlty Melon Crowdlending Cash Withdrawals

You can make withdrawals of available cash in Zlty Melon from a single euro, and we must know that they are processed quickly, having the money available in our bank account just one or two business days later. We must take into account, yes, that each withdrawal order we make has a fixed cost of 20 cents.

Is Zlty Melon safe? Risks and Regulation

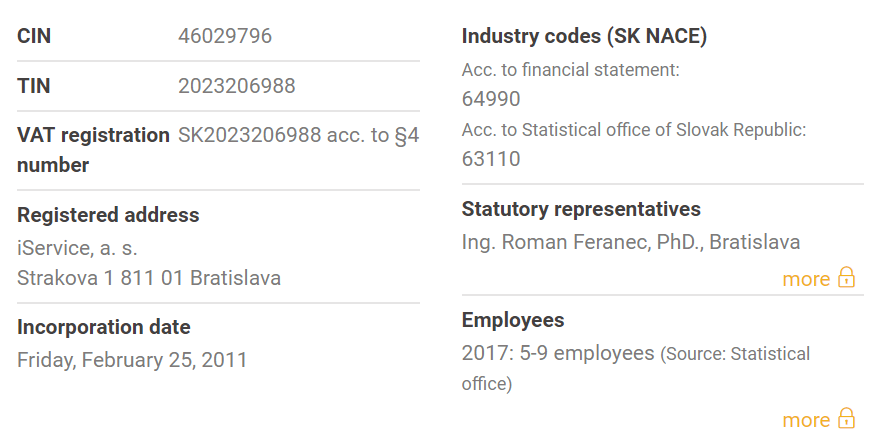

iService, as is the parent company that operates Zlty Melon, and has registered in Slovakia since February 2011 with registration number (VAT) SK2023296988. It is difficult to find a platform so veteran and with a long trajectory in the P2P world like the one we are dealing with today (in fact, of all the platforms that we have analyzed only Bondora surpasses it by seniority).

As in other P2P loan pages, Zlty Melon offers us an attractive return on our savings, but – as with any investment – we must be aware of the implicit risks, let’s see some of the most relevant ones and what measures Ztly Melon takes to mitigate them:

Risk of Lack of Liquidity

One of the things that we have to take into account with any crowdlending platform is the lack of liquidity of the investment. Loans often arise for one or several years, and theoretically, our investment is – at least partially – blocked until the end of the operation.

In Zlty Melon there is a Secondary Market that allows us to increase the liquidity of our holdings in loans, given that at a given time it will allow us to sell our loans to other investors. Even so, we must bear in mind that it is possible that the sale of our shares is not made at the price we want, always depending on the supply and demand of the market.

Risk of non-payment of loans by borrowers

The default and inability of the borrower to repay the loans in which we have invested is always one of the biggest risks we have in most P2P platforms.

At Zlty Melón we have a complete risk classification that can serve as a guide to decide which operations are appropriate to our tolerance level, ranging from loans with Mortgage Guarantee to High Risk loans.

Bankruptcy Risk of the Platform

Although it is a remote possibility, we must always consider the possibility that the crowdlending platform in which we invest, breaks. In the case of Zlty Melon, he is backed by more than 8 years of experience in participatory loans without any incidence . This track-record is much more than what other platforms can contribute.

In addition, Zlty Melon has the support of EU-JEREMIE-Fund. A European Institutional Investment Fund as a shareholder through the JEREMIE program (promotion of European SMEs).

ZtlyMelon Web Ergonomics and Reports

Zlty Melon has a peculiar web, a little different from the other platforms that we usually evaluate.General feelings are good , and veteran crowdlenders will have no problem getting familiar with the interface quickly, but it may cost a bit more for newbies. It is NOT currently translated into Spanish.

If we carry out the study that we usually carry out about how many clicks are necessary to perform some of the most basic actions in the platform, we obtain the following results:

★★★★ 4 clicks to invest in one of the loans.

★★★ 3 clicks to see the status of one of the projects in which we have invested.

★★★ 3 clicks to withdraw money.

Which is acceptable, being more or less in the average of other websites analyzed.

ZltyMelon Real Annual Net Return Expected

✰ Zlty Melon presents an average gross return of approximately 11 % , depending on the type of loan and the credit quality of the borrower

✰ Presents a service fee of 1% for loans up to date with payment (there is no charge for delayed loans).

✰ We estimate that the average loss of a diversified long-term global portfolio can be around 2%

✰ The estimated annual average net profitability, therefore, is 11% base less (2 + 1)% of losses = 8% net annual for a well-diversified portfolio in the long term , which is slightly below the average of platforms of crowdlending evaluated on this web.

Taxation iService as – Tax Retention

Zlty Melon DOES NOT practice any retention of the interests obtained in its platform. It is our responsibility to declare them in the IRPF / Annual Income Tax Return. Remember that the interests of crowdlending are taxed as return on movable capital. In case of doubts, please consult with a tax advisor.

Zlty Melon P2P Lending – Contact Information and Customer Service

Zlty Melon is the only P2P platform based in Slovakia (with its headquarters in Bratislava) . It has an Investor Service telephone number which is +421 254410084 and an email contact that is zltymelon@zltymelon.sk

In our experience it has a very good level of Customer Service , with an internal ticket system within the platform that works very well, giving a quick solution to any question or doubt that we raise.

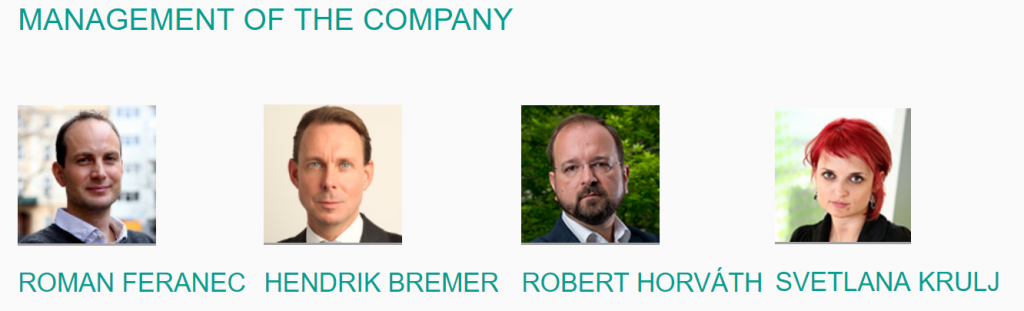

The Team behind the Company

Zlty Melon is led by its co-founder and Chairman of the Board, Roman Feranec, an experienced manager with extensive experience in the world of finance and the real estate market.

He is accompanied by professionals of the stature of Hendrik Bremer, with more than 20 years of experience in the financial sector, Robert Horvath or Svetlana Krulj.

What can certainly not be denied is an interest in doing things differently, with a fresh and original approach that allows them to differentiate themselves from the competition in the world of P2P lending, from their registration form to the video blogs that they publish on their YouTube channel.

Our Personal Investment Strategy in Žltý Melón

✰ Diversification above all: In this platform we follow a pattern of manual investment in which we allocate 50% of our capital to standard loans, 25% to guaranteed loans and 25% to HR loans. We always invest the minimum per operation (25 euros) in the largest number of loans possible.

Opinion Zlty Melon 2023 – Final Conclusion

Zlty Melon is a platform of different crowdlending, ready to break molds, not without some shortcomings, but surprisingly versatile and very interesting from a diversification point of view since it is the only Slovak P2P investment website.

Maybe it is not the first option for a newcomer to the world of Peer to peer lending, but for the crowdlenders that already have a handful of Latvian, Estonian and Lithuanian platforms, it is an excellent alternative to enrich the diversity of our assets.

Advantages of Zlty Melon – Strengths

➊ Slovakia’s only crowdlending platform, which will bring diversity to our global asset portfolio.

➋ Very veteran platform, with more than five years of unblemished trajectory in the P2P sector.

➌ Interesting mix of investment assets with traditional personal loans, mortgage loans and HR operations.

➍ Attractive periodic cashback promotions for investors.

Weaknesses and Aspects to improve

➊ A portfolio management fee of 1% together with acceptable gross returns, but not brilliant, make the average net profitability somewhat better.

➋ The user interface may not be the most accessible and intuitive for newcomers to the world of P2P investments.

Alternatives to Zlty Melon Review

Zlty Melon is unique in that it is the only P2P platform from Slovakia. It is clear that there are more complete and more profitable platforms than the one we are dealing with today, and it is easy for us to come up with classic examples such as Mintos or Grupeer … but the truth is that Ztly Melon will contribute something that these platforms can not: diversification the concentration of capital in Baltic platforms and operations.

Žltý melón Forum

Do you want to have a space to comment and share your doubts and experiences about this Slovak crowdlending platform? … Look no further, here below we enable the Zlty Melon Forum so you can express yourself and ask freely … Write us your comment! 🙂