Monefit SmartSaver is a new investment platform belonging to the Creditstar Group and operated by the well-known Lendermarket that follows a model similar to other already established and recognized solutions such as Bondora Go&Grow or IUVO Save to offer us an investment account with a target return of 7% per year. and in principle total availability of our money within a maximum period of 10 business days.

Is it worth it? Is it reliable? Is it safe?… Do you want to know ALL our opinions after investigating and testing it from the inside?… Don’t miss our review!

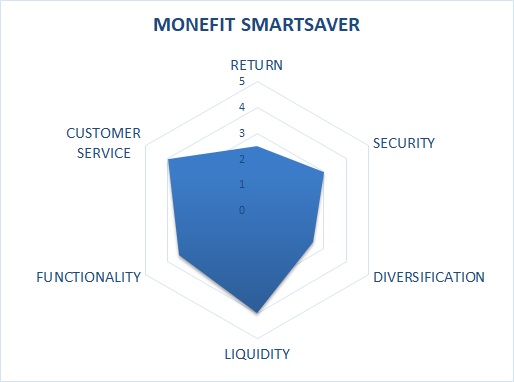

Monefit SmartSaver Review – Critical Performance Parameters Opinion and Analysis – Hexastar Chart

PROFITABILITY: With a 7% target return, it is true that Monefit Smartsaver is at the forefront of BlackBox Crowdlending platforms, surpassing solutions such as Bondora Go&Grow or IUVO Save in terms of performance… even so, it is possible that this annual interest rate does not satisfy to the most active crowdlender profiles, accustomed to double-digit returns on platforms -yes- that require a little more involvement in their configuration and set-up.

SECURITY: When we deposit our money in Monefit SmartSaver we are actually investing in an underlying consumer loan portfolio from the Creditstar Group, one of the most recognized brands in the crowdlending industry.

DIVERSIFICATION: By investing in the Monefit platform we are distributing our capital in a significant number of different operations, all of them linked to the same Originator or Group of Originators. On the other hand, at the moment there is only one type of investment in Monefit SmartSaver, without us being able to make adjustments in terms of profitability, risk, etc.

LIQUIDITY: One of Monefit’s sales arguments is the total availability of our capital (without blocking periods) within a maximum period of 10 business days… Which is undoubtedly truly interesting, although we must bear in mind that ultimately the Liquidity could be affected by market conditions, especially in extreme situations.

FUNCTIONALITY: With a clean and refined interface, especially aimed at new investors, we cannot put any fault in this particular beyond the inherent limitations of this basically black box crowdlending modality. they give us everything done and set up beforehand.

CUSTOMER SERVICE: Using the experience accumulated by the Lendermarket team, Monefit Smart Saver starts with a good starting point to efficiently serve its investor users.

Is Monefit Reliable or Not – Due Diligence Findings Is it safe?

*Monefit SmartSaver is a brand of the company Monefit Card OÜ company of Estonian origin founded in 2010 with headquarters in Harju maakond, Tallinn, Lasnamäe linnaosa, Sepapaja tn 4, 11415, registration number 11953111 and share capital of 50,000 euros.

*In the registry it appears as its main business activity “Other financial service activities, except insurance and pension funding nec” which is in line with the activity of the platform in question.

*The record shows the presentation of the annual accounts every year to date and the absence of any debt or open judicial process.

With the information collected, there is no a priori reason to think that Monefit SmartSaver is a scam or any fraudulent company.

Monefit Opinion P2P Crowdfunding Review

Advantages of SmartSaver Monefit – Strong Points

1) Simple and uncomplicated investment, in a few clicks and from just 10 euros. Paradigm of simplicity and ease of use.

2) Performance and liquidity above average compared to other investment products with a similar profile offered by the competition.

3) It is always appreciated that it goes on the market with the endorsement of an experienced operator such as Lendermarket and an important Group within the crowd sector such as Creditstar

Weaknesses and Aspects to Improve – Monefit Smart Saver Opinions

1) Precisely its membership of the Creditstar group, despite the experience and brand strength it brings, can be seen as a double-edged sword by some veteran investors concerned about the restructuring of payments on other platforms.

2) Despite the fact that 7% is an interesting return for this specific crowdlending niche, it is possible that for an expert user it falls a bit short.

3) Platform of relatively recent creation. It remains to assess the performance of the platform (liquidity, profitability commitment, etc.) in adverse market scenarios.

Monefit SmartSaver Forum

Do you want to have a space to comment and share your doubts and experiences about this Estonian crowdlending platform?… Look no further! Here below we enable the Monefit Forum so you can express yourself and ask freely… Write us your comment!