Do you want to know more ?, then stay because right now we tell you our impressions and experience as users of this aggregator.

Tribe Funding Review – Critical Performance Metrics Opinion, Analysis and Review

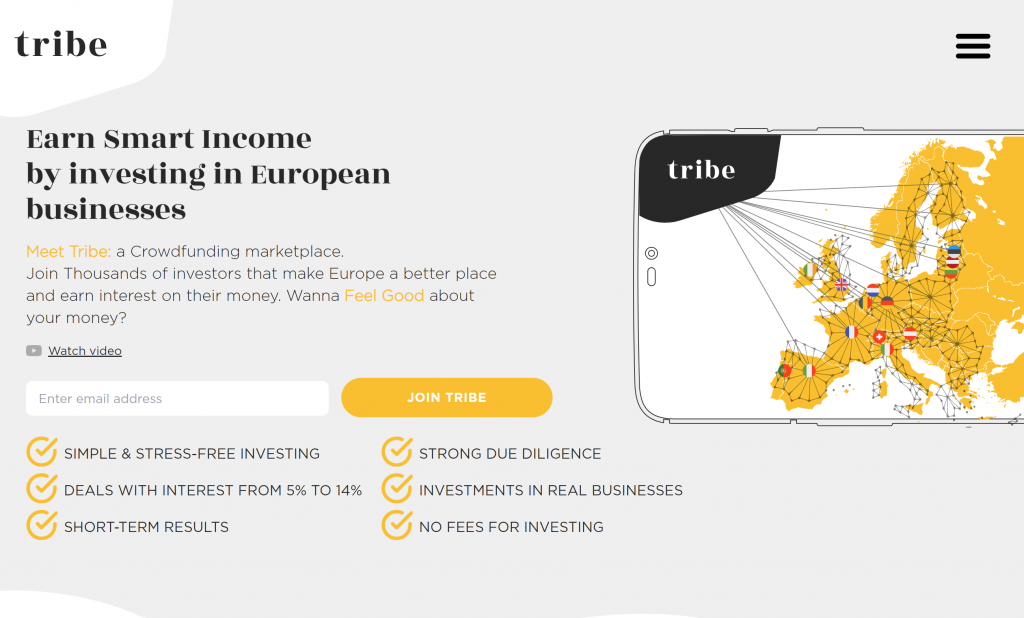

Without a doubt, Tribe Funding uses its enormous diversification as a flag and argument to get invested, already having more than half a dozen interesting platforms of very different types and with new additions planned to be added in the short-medium term, once they pass the corresponding controls and Due Diligence checks.

In its interface we will find well-known names both within Spain (Emprestamo, Housers…) and Europe (Heavy Finance, Raizers,…) which is proof of the global reach and the vote of confidence that these Partners have granted to it. Also noteworthy here is its alliance with Ondato (KYC) and Paysera (payments), two of the leading providers in their respective sectors in Europe.

On the other hand, being a crowd aggregator, the Profitability, Security and Liquidity parameters will always tend to be in the middle zone since they precisely “add” loans and operations of all kinds, from short-term crowdfactoring to long-term real estate operations.

What does Tribe Funding consist of? How does it work?

Tribe Funding is essentially an aggregator, that is, a platform through which we can invest in the projects of dozens of different platforms, which precisely seeks to solve 4 fundamental problems:

1 – Saturation

One of the biggest challenges of crowdfunding is saturation. By 2021, there were already more than 800 crowdfunding platforms up and running in Europe alone, and the number continues to grow. Alternative investments, such as those allowed by crowdfunding models, are intended to provide a faster and more accessible route to invest. However, they are of no use when potential investors are bombarded daily with thousands of deals from hundreds of platforms that can leave even professional investors overwhelmed.

2 – Fraud

Scammers pose a great risk to crowdfunding. In the midst of all that noise, bogus platforms with no records raise money for counterfeit companies who take the money invested for personal use rather than spending it on the project. Often in this case, projects are never completed and investor requests for return are ignored. This occurs in large part because investors do not know what to look for in projects and which platforms are originating those projects.

3 – Fragmentation

Until now, platforms that intend to expand internationally throughout the European Union have had to invest significant resources in launching them in each of the individual Member States. Furthermore, in most cases, after reviewing the legal frameworks of other countries, many platform operators decided not to expand their operations at all. Therefore, until now, crowdfunding services have been limited to local markets and have not been able to develop in the single market of the European Union.

4 – Insufficient supply

The vast majority of crowdfunding platforms active in the European Union cannot provide investors with a sufficiently wide range of offers; On average, a single platform is limited to launching 5-8 offers per month. Which means that, in order to build a diversified investment portfolio, investors have to join 5-7 different crowdfunding platforms and constantly jump through them looking for deals and monitoring the performance of their investments, it’s not that easy. , Huh?

That’s why Tribe Funding, a technology company run by finance and software experts, has launched a crowdfunding marketplace. A portal, where offers are provided by multiple verified crowdfunding platforms. Just like Amazon does with retailers and Booking.com does with hotels, Tribe collects the best deals in one place and makes them safe and easy to access for investors.

Tribe’s goal is to simplify the increasingly complex European crowdfunding scene through a frictionless platform that provides users with access, options and the security of a market committed to high standards. On the same platform, people can access a wide range of investment opportunities in different asset types and sectors, allowing them to build and maintain a well-diversified and protected investment portfolio.

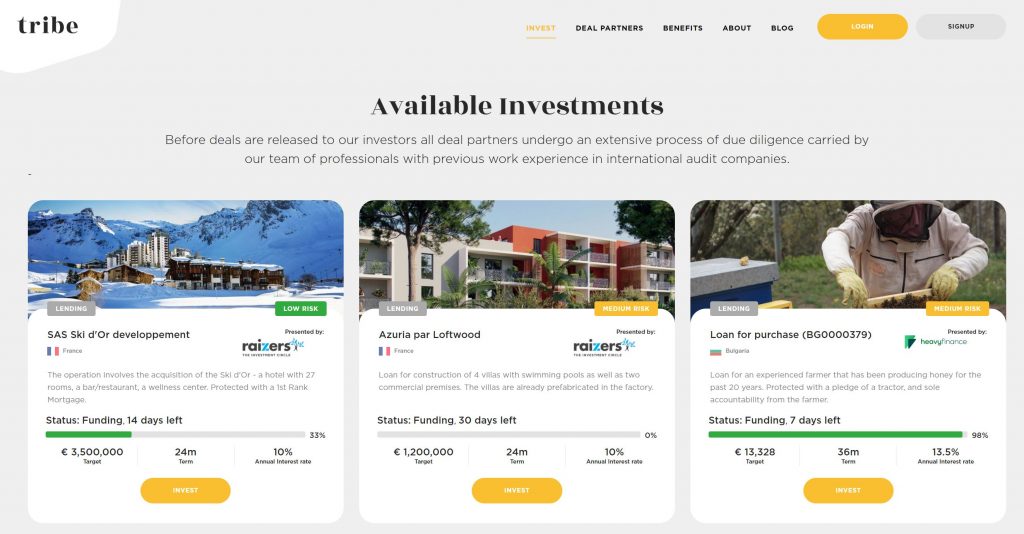

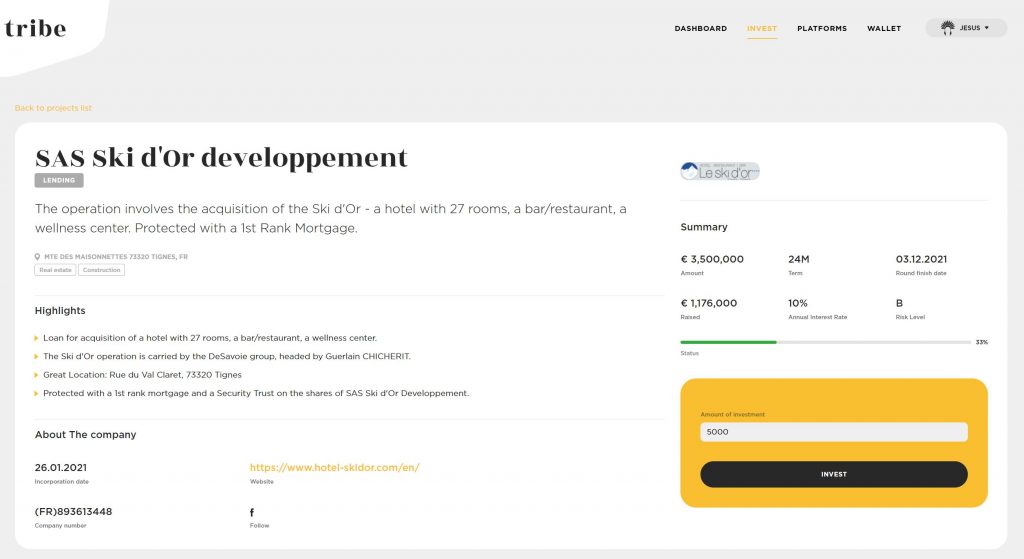

Here are some screenshots of what the available offer and information on each project look like:

TribeFunding Partners – Meet the Included Platforms Template!

- RAIZERS: One of the leading real estate crowd platforms in Europe, authorized by the French regulatory body.

- HEAVY FINANCE: One of the great revolutions of 2020, at the forefront of agricultural loans in Europe with very interesting returns.

- MAX CROWDFUND: Real estate crowd platform that integrates investments in real estate in the blockchain, prioritizing transparency.

- GOPARITY: One of the benchmarks for ethical crowdlending in Europe, authorized by the Portuguese regulator.

- HOUSERS: Leader in real estate crowdfunding in Spain by number of registered investors. Despite being undoubtedly a controversial platform, its recent turn to home equity loans may have a place at Tribe Funding.

- LENDSECURED: Another of the best additions to the crowd world of 2020 with real estate and agricultural operations.

- BETTERVEST: German impact investing platform.

- EMPRESTAMO: One of the most appreciated crowdfactoring platforms in Spain, with invoices from SMEs and Public Administration.

- ROIER: Real estate crowdfunding company based in the Czech Republic.

It is important to note that ALL partners undergo an extensive due diligence process carried out by a team of professionals with previous work experience in auditing companies and international banks. Furthermore, within each Partner, only trades that pass our internal due diligence are published, which adds a layer of security for investors.

Finally, all the published offers have some type of security / protection, be it mortgage, insurance or exclusive responsibility.

Opinion Tribe Funding Crowdfunding Review and Analysis

Tribe Advantages – Strengths

➊ Wide range of types of operations available, from factoring to real estate, being in this sense probably the most complete aggregator to date.

➋ More than half a dozen platforms included in its outlet catalog, with a good handful more on the way for the next few months.

➌ Investments from 100 euros per operation (even in platforms that have a higher minimum such as Raizers, etc.) and operations WITHOUT commissions for the investor -except withdrawals-.

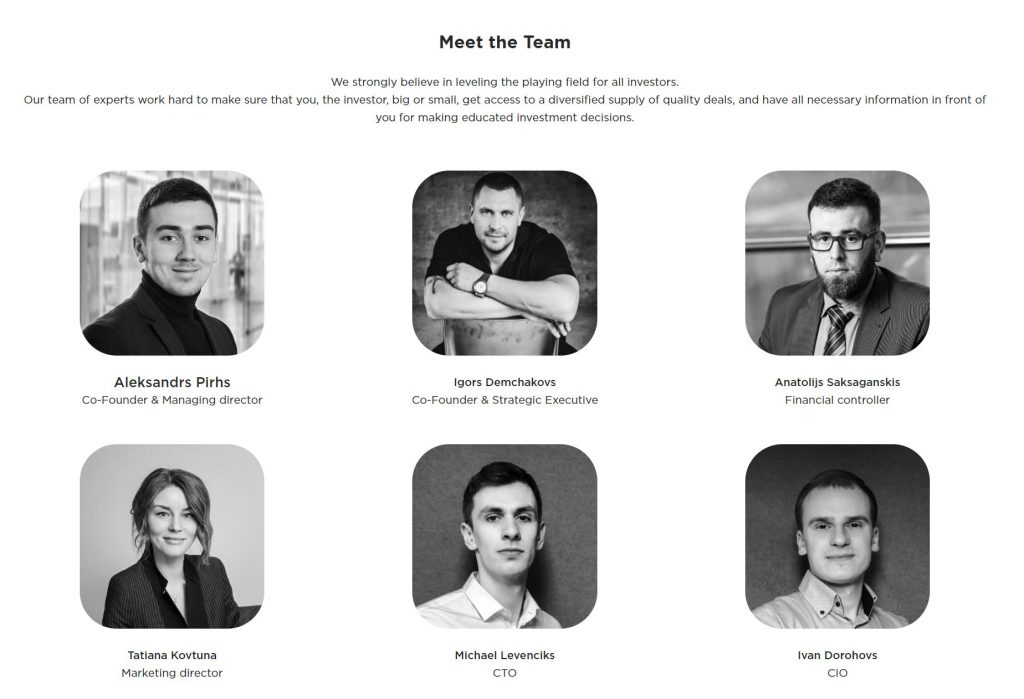

➍ Solid Due Diligence process both at the Partner level and at the operation level and experienced personnel in its Management Team such as Igors Demchakovs, co-founder of Tribe Funding together with Aleksandrs Pirhs and also founder of one of the world leaders in aggregation in the hospitality sector , BookingGroup.

➎ The founders of the platform invest their own capital together with investors in the “Low-Risk” projects listed in Tribe (Skin in the Game)

Weaknesses and Aspects to improve – Opinions

➊ It is still a relatively recent platform that is still building its portfolio of Partners and investors. You need to gain volume and collaborators to break into the crowd scene with force. Still it is true that it has a promising starting grid in every way.

➋ We are missing a few additional tools such as the Secondary Market and Auto-Invest, which we understand will come as your volume of operations increases.

Tribe – Contact details and business details

Tribe Funding OÜ, with registration number 14955911 and incorporated in April 2020, has its registered name in Harju maakond, Tallinn, Kesklinna linnaosa, Ahtri tn 12, 10151, with contact telephone number +44 (20) 81572120 and +372 6989966 and email for inquiries at info@tribefunding.eu

In our interactions with those in charge, they have answered all our doubts and questions in an agile and diligent way.

The Team Behind Tribe

Here are some of the more interesting facts from Tribe’s co-founders: Igors Demchakovs and Aleksandrs Pirhs

Igors is an entrepreneur who has created several businesses throughout his career from the ground up. He is in fact also the founder and president of BookingGroup, one of the largest aggregators in the international car rental market. Today, the company occupies one of the leading positions in the industry, with a turnover of more than 45 million euros, offers its services in more than 150 countries and 20,000 locations, and has more than 850 partners.

Alex is a specialist in product management and business development, one of his last work experiences being the creation of the exclusive P2P platform of a well-known loan originator: DoZarplati.

How to Start Investing in Tribe

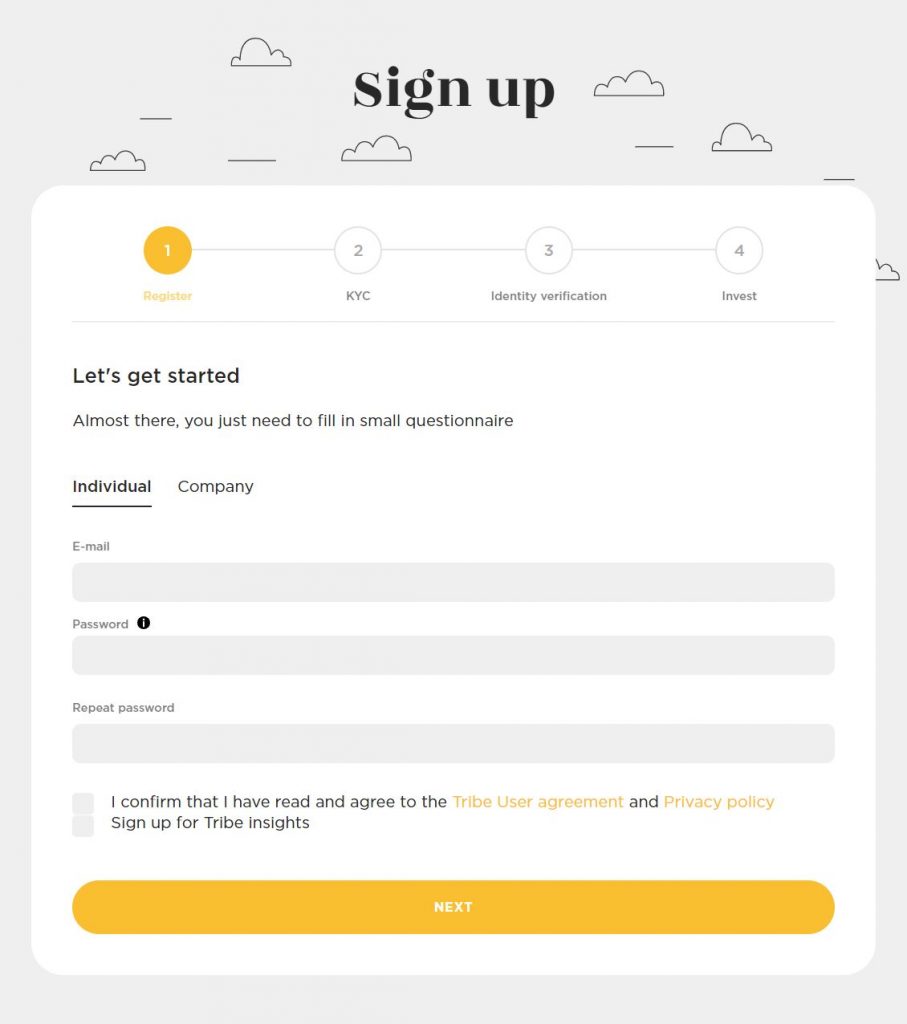

The account creation process at Tribe Funding is really straightforward and typically only takes a few minutes (usually no more than 5 minutes) . It begins with a basic data form, continues with the standard KYC (Know Your Customer) process where we must also validate our identity with our identity document and a selfie. Finally, we must make a first deposit via bank transfer to the account number and identifier indicated in our user interface.

TribeFunding Forum

Do you want to have a space to comment and share your doubts and experiences about this Estonian platform of crowdlending aggregators?… Look no further! Here below we enable the Tribe Funding Forum so that you can express yourself and ask freely… Write us your comment !