Quanloop is a crowdlending platform -or rather an alternative management fund- somewhat different from others that we know, whose mechanics are based on the microlending of blocks of 1 euro to the platform itself for a period of 24 hours and the repetition of said operation in a loop on the days we want. Its advantages include a more than acceptable profitability and the practically immediate availability of our capital, so it well deserves a closer look …

In this review we share all our opinions about the platform as users of it… Don’t miss it!

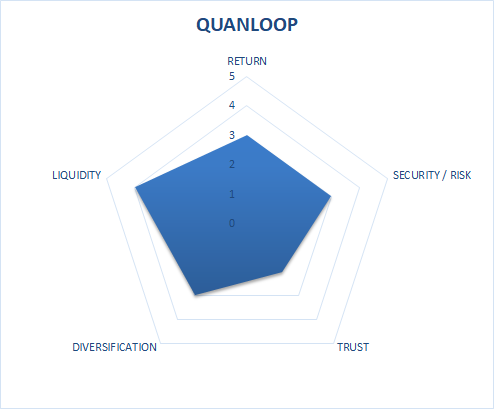

Quanloop Opinions – Critical Performance Parameters

RISK: Quanloop has a great peculiarity compared to other crowdlending platforms that we are used to, and that is that by investing within the platform we are lending money to Quanloop itself, not directly to the associated originators. Therefore, although individual operations may be covered by mortgage guarantees and the like, they have no buyback… It would not make sense given that the repayment commitment is from Quanloop to us, not from the originator / issuer of the loan to us.

TRUST: Quanloop is a fund supervised by the Bondkick company, registered in Estonia as a fund manager with license FFA000250. Both Quanloop and Bondkick companies are managed by businessman Valentin Ivanov. Being a young company and with a certain opacity inherently linked to its conceptual design, we consider that Quanloop can improve in this regard.

DIVERSIFICATION: Internally, the diversification within Quanloop (intra-platform diversification) is extremely diversified, with our capital fragmented into one-euro micro-blocks allocated to different operations and generating returns autonomously. However, despite this, we must be aware that ultimately, ALL investments depend solely and exclusively on Quanlop, which is our sole Originator / Borrower, diversification in this sense being null.

LIQUIDITY: One of the distinguishing features of Quanloop is that the loan period is always 24 hours. This, in practice, implies that we have a priori with great liquidity for the capital that we deposit in the platform, which in one or two business days should be back in our bank account if we request it. All this, as indicated on the Quan loop website itself, is expected under normal market conditions. Extraordinary situations could cause these repayment periods to be longer.

Quanloop Crowdlending Review

Quanloop Advantages – Strengths

➊ Platform of relatively high profitability with total availability of the invested capital in a few days under normal conditions.

➋ Business model supervised by an official fund manager regulated by the Estonian authorities (Bondkick FFA000250)

➌ Rewards program by which each month you are automatically credited the loss of purchasing power of the money you have deposited and stopped at Quanloop based on the CPI and inflation in Spain or your country of origin.

Weaknesses and Aspects to improve – Quan loop Opinions

➊ The features and novel approach are embodied in an unintuitive Autoinvest, which may be difficult to understand and custom configure at first.

➋ There is no detailed information on the partners / companies that Quanloop works with and that are part of its loan portfolio. It can improve transparency.

➌ The performance and availability of our capital ultimately depend on the viability and performance of the platform itself, with a concentration of risk in this regard.

Quanloop Forum

Do you want to have a space to comment and share your doubts and experiences about this Estonian crowdlending platform?… Look no further! Here below we enable the Quanlop Forum so that you can express yourself and ask freely… Write us your comment!