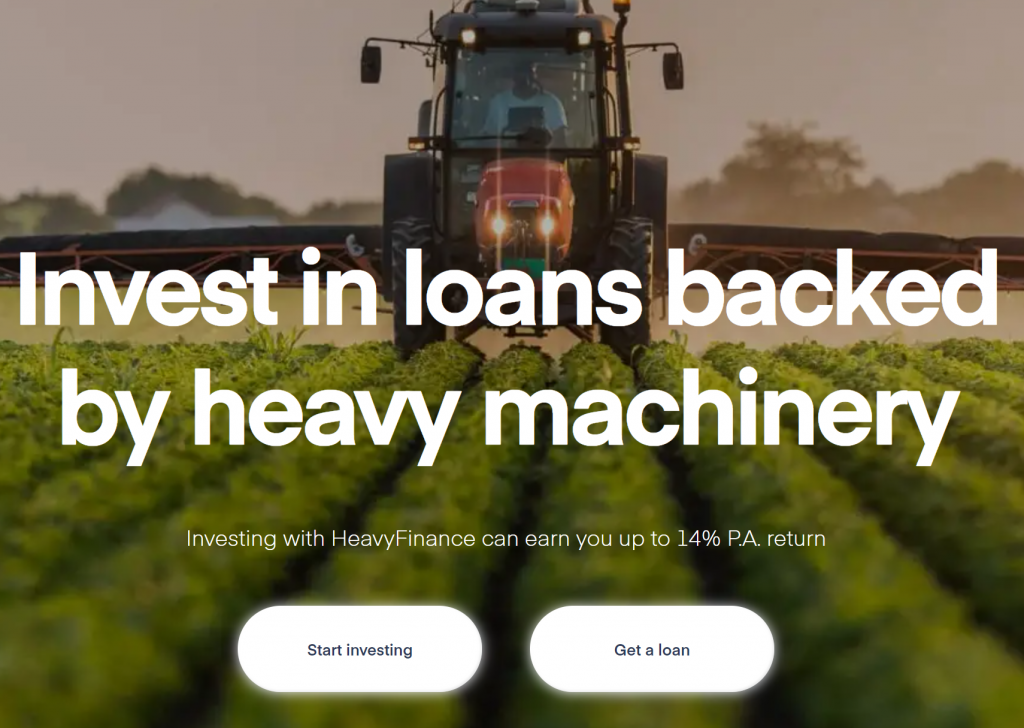

HeavyFinance.com is a one-of-a-kind crowd investment platform, given that all its projects are covered by mortgage guarantees, yes, but in this case we are not talking about mortgages on real estate but mortgages on heavy agricultural machinery (tractors, shredders, etc. ), in this way we have before us a marketplace that allows us to invest in secured loans while diversifying the type of asset compared to the typical real estate mortgage guarantee platforms.

This is indeed the only marketplace that operates solely in the agricultural sector, which means that by investing through HeavyFinance we have an option to tap into one of the most underfunded, yet heavily subsidised and strategically important sectors in the EU.

In this review we share all our opinions about the platform… Don’t miss it!

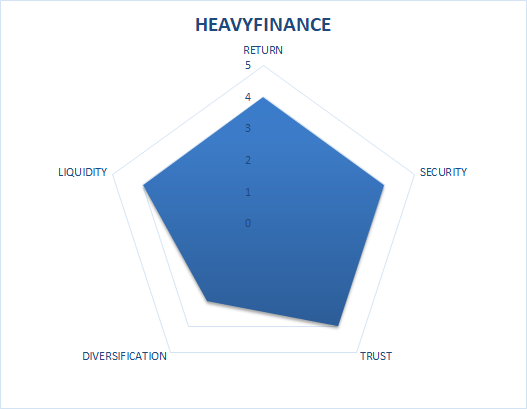

Heavy Finance Opinions – Critical Performance Metrics

RETURN: HeavyFinance offers returns above the average of the crowd sector, in a range typically comprised between 10 and 15%, with averages around 13%. It also has the particularity that it usually offers a progressive profitability in its projects, which increases as the capital invested in a given project increases, with spreads that reach up to 2 percentage points.

RISK: All operations in HeavyFinance are covered by heavy machinery: in case there are problems in the repayment of a specific loan, HeavyFinance will proceed to the sale of the mortgaged assets to ensure the collection thereof. From that point of view, comparing HeavyFinance with other secured lending companies such as Estateguru, it must be taken into account that agricultural machinery is more liquid and can better preserve its value in times of crisis than real estate.

TRUST: Heavy Finance has the authorization and direct supervision of the Central Bank of Lithuania, and is subject to strict regulations that include, for example, the segregation of funds from its investor users. In this sense – like the rest of the Lithuanian platforms – it has a robust regulatory framework unlike most Latvian and Estonian platforms. In addition, although it is true that it is a recently created platform, it has personalities with a long history and reputation in the sector (its CEO and founder, Laimonas Noreika has previously been the CEO of a veteran in the sector like Finbee for 4 years) .

DIVERSIFICATION: Since it began its journey in 2020, Heavy Finance has decisively improved in this area that used to be its Achilles heel… Not only does it now have a solid and convincing volume of operations in which to invest (often with more than a dozen options available at all times) but also at the Geo level we can choose from a range of operations that include Lithuania, Latvia, Bulgaria, Portugal and Poland.

LIQUIDITY: Equipped with a fully functional and active secondary market from the beginning, the average terms of operations of more than one year should not be a problem if we need our capital in advance thanks to this means of exchange between users.

Opinion HeavyFinance Crowdlending Review

Advantages of HeavyFinace – Strengths

➊ Crowd platform based on mortgage guarantees on agricultural heavy machinery, undoubtedly a sector that will bring a breath of fresh air to our portfolio and will reinforce the portion of secured lending that we have.

➋ Known management team, with years of experience in another regulated platform such as Finbee.

➌ Platform regulated and supervised by the regulatory body of your country of origin. With accounts segregated via LemonWay.

➍ Functional and active market from minute 1. Ideal in case long terms put us back.

Weaknesses and Aspects to improve – Opinions HeavyFinance.com

➊ Relatively new platform. Although since inception they have already established an impressive lending track record worth 20 million euros and paid our more than 1 million of interest to their investors already.

HeavyFinance Forum

Do you want to have a space to comment and share your doubts and experiences about this Lithuanian crowdlending platform?… Look no further! Here below we enable the HevyFinance Forum so that you can express yourself and ask freely… Write us your commentary!