Trine is an interesting Swedish platform created in 2016 and authorized as a financial entity by Finansinspektionen that pursues the philosophy of the so-called “triple benefit” of investments: economic performance, social impact and the improvement of the environment … all this allowing us to invest in solar energy projects located in developing countries and providing an attractive return and a positive impact for our savings.

Too good to be true? we have been among the first to thoroughly test this platform and in this MEGAreview we tell you our impressions and all the information you are looking for … are you ready? 🙂

What is Trine Statistics and Global Data

Trine is a Sweden-based company specializing in renewable energy investments in a wide range of countries around the world.

Throughout its more than 3 years of existence, it has accumulated a portfolio with almost 10,000 active investors that together have financed projects worth almost 30 million euros contributing to bring electricity to more than 2 million people in need while they have avoided more than 100,000 tons of CO2 in the atmosphere, and all this obtaining profitability around 7.6% for investors.

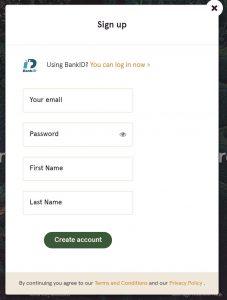

First Steps at Trine Finance Ltd

Registration in Trine is a very simple process, similar to that of other crowdlending investment platforms that will not take us more than a few minutes and includes the following steps:

➊ Fill in the initial investor registration form.

➋ Fill in the personal data in our newly created account.

➌ Provide proof of identity to carry out the verification (ID or Passport).

➍ Make the first investment by bank transfer or credit / debit card.

Requirements to create an investor account in Trine

+ Be of legal age

+ Registration is open to citizens of ALL nationalities

Deposits How to add funds to our Trine account

Contributions can be made by bank transfer or directly by credit or debit card.

Trine Bonus – New Users Bonus

Trine currently offers a very attractive promotion for new investors who want to try the platform, consisting of a bonus of 10 euros to be deducted from the first investment from 25 euros simply by registering. To access this promotion, you simply have to register from HERE .

How Trine Commissions Works

Trine has absolutely NO commissions for the investor. A platform “0,0” as we like on this page 🙂

How to Invest in Trine Crowdfunding in 2024

Trine has two investment modalities:

- MANUAL Investment from 25 euros per operation

- AUTOMATIC Investment in which a monthly amount is defined to invest in Trine projects that meet our criteria, with a minimum of 50 euros per month.

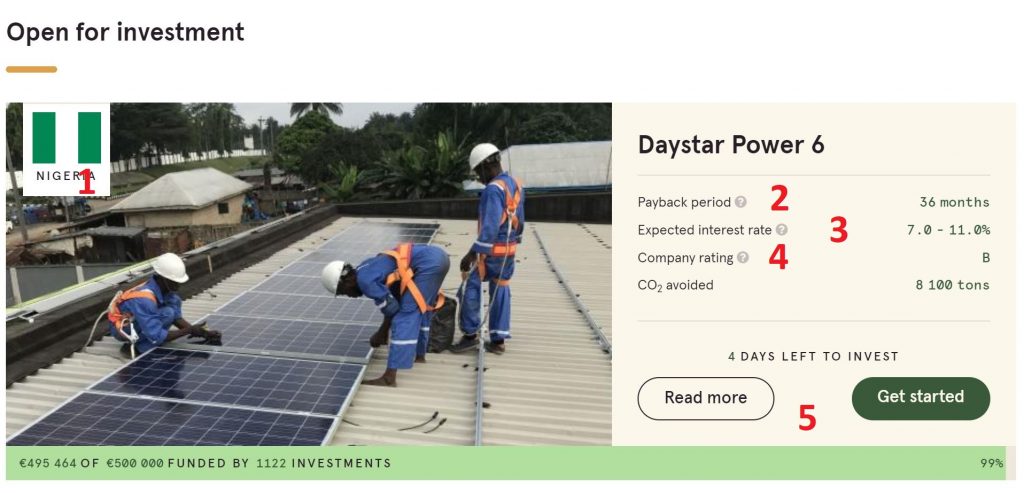

Manual Investment Trine Analysis – Most Important Parameters

➊ Country

Trine specializes in financing projects in developing countries , where their effect can positively impact as many people as possible. Kenya, Zambia and Nigeria are 3 of the countries in which this platform is most active, but we will also find investment opportunities in America (Guatemala) or Asia (India, Pakistan …)

From the point of view of diversification, this is one of the pluses of the platform, since it allows us to invest in very rare countries in other crowdlending companies.

➋ Payback Period (Term)

Loan duration in months. Here it is necessary to take into account that the majority of operations in Trine arise in the medium-long term (from 1 to 5 years), but the advantage is that the loans are AMORTIZABLE , that is, that in each monthly installment we will receive our interests and an aliquot portion of our capital, so that our money will not be blocked for so long.

➌ Expected Interest Rate

In Trine we can find average returns in the environment of 8%, with the particularity that each project has its own incentive system in such a way that profitability is progressively increased depending on the amount of money we invest (hence in the project files see a range, for example from 7 to 11%).

➍ Company Rating (Borrower Risk)

The Rating is a measure of the risk of default by the borrower and ranges from “A” (the safest) to “D” (the highest risk). In Trine an exhaustive analysis of the company taking the loan is carried out, which includes from its financial profile to its experience in similar renewable energy projects.

➎ Read More

If we click on the READ MORE button we will go to a screen where we can find more details about the operation in which we are interested in investing and / or we can confirm our investment.

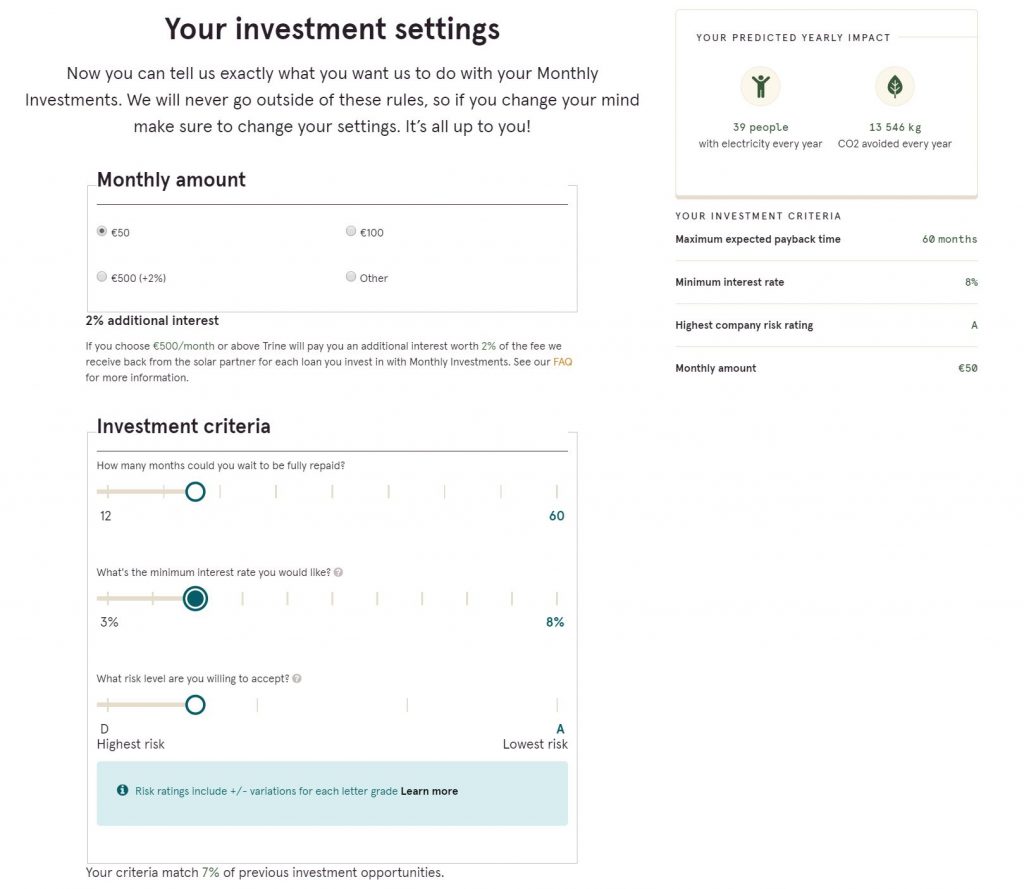

Trine How Autoinvest Works (Automatic Investment) – Step by Step Tutorial and Configuration

Trine has a slightly different Autoinvestment functionality than we are used to, and instead of specifying a maximum amount that we are willing to invest in each loan, what we will specify here is how much money we would like to invest in Trine each month.

We can indicate from 50 euros per month, but if we dare to invest 500 euros or more we will automatically receive a 2% bonus on the basic profitability of each project in which we participate.

Once we have clear the amount to invest, we will limit the projects in which we are willing to participate (specifying ranges of profitability, deadlines and rating) and the automatic manager of Trine will be responsible for distributing the assigned monthly amount among the largest possible number of operations that fit those parameters that we have specified.

Trine Secondary Market and Liquidity

Trine does NOT have a secondary market or other equivalent mechanism to recover our investment in advance if necessary, which is one of its main weaknesses. Even so, we must bear in mind that all loans on this platform are amortizable, so we will recover a portion of our capital invested in each monthly installment.

Trine Buyback Guarantee

Some Trine loans (NOT all, only those explicitly indicated) have partial coverage of the capital invested – around 50% of it – through SIDA (Swedish International Development Agency), an official agency government agency dependent on the Swedish government that protects a portion of the capital invested in certain projects in Trine.

Trine Crowdlending Originators

Trine has an interesting range of originators depending on the country in which the project will be executed. Each originator has a Rating of “A” to “D” as we have explained previously, being “A” the most reliable profile and “D” the most risky.

Trine Finance Limited Pay – Cash Withdrawals

Trine allows us to withdraw our available balance at any time and from one euro, without charging any type of commission to the investor . Usually withdrawals are processed quickly and in one or two business days we will have the money back in our bank account.

Is Trine safe and reliable? Risks and Regulation

Trine is a Swedish company supervised by the Financial Supervisory Authority (FSA) of Sweden . It is undoubtedly a serious and reliable company, but like the rest of crowdlending platforms it is not without risks, some of which we indicate below:

+ Risk of lack of liquidity of our investments

+ Risk of investing in emerging countries

+ Risk of non-payment of loans by borrowers

+ Bankruptcy risk of one of the originators

Ergonomics Trine Limited Web and Reports

The Trine website is very simple to use, with great simplicity and clarity in the presentation, being suitable to navigate even for the most novice in the world of crowdlending.

If we carry out the study of distance in clicks for the most common operations that we usually carry out, we obtain the following results:

★★★★★ 5 clicks to invest in one of its operations.

★★★ 3 clicks to see the status of one of the loans in which we have invested.

★★★ 3 clicks to withdraw money.

Which is a little above the average of the crowdlending platforms analyzed, partly because of the legal requirements of the platform to make a quick questionnaire prior to any investment.

Trine Expected Real Annual Profitability

✰ Trine has an average gross return of approximately 9 % , depending on the specific opportunity.

✰ It does not present any commission, so it is not expected that there will be losses in this regard.

✰ The default rate currently exists is 1.4%

✰ The estimated annual average net profitability, so it is 9% less (1.4)% of losses and commissions = 7.6% annual net for a well diversified long-term portfolio , which is slightly below the average crowdlending platforms evaluated on this website, but above the average compared to other solidarity crowlending companies.

Taxation Trine – Tax Withholding

Trine does NOT practice any withholding of interest earned on its platform. It is our responsibility to declare them in the IRPF / Annual Income Statement. Remember that crowdlending interests are taxed as movable capital yield. If in doubt, please consult with a tax advisor.

Trine P2P Lending – Contact Information and Customer Service

In addition to traditional media and social networks, Trine has a chat in which we can instantly consult any questions we may have directly with the platform management team. They have physical offices in Gothenburg and are very active on Twitter, Facebook, Instagram and other social networks.

The Team behind the Company

Trine has a large team of professionals who contribute their experience, talent and expertise to bring to fruition each of the published projects. Captained by Sam Manaberi, CEO and co-founder of the project, these are its main components:

- SAM MANABERI – CEO and confounder

- CHRISTIAN GENNE – CTO and co-founder

- ANDREAS LEHNER – Technology specialist and co-founder

- CHRISTOFFER FALSEN – Sustainable Finance Specialist and Co-Founder

Is Trine Finance reliable? Opinion Forums, Networks, Aggregators …

Trine accumulates positive reviews and reviews by almost all users who have tried it, without any negative comments, and with the following scores in each of the opinion aggregators to date:

| STARS | OPINIONS | |

|---|---|---|

| TRUSTPILOT | 6 | |

| 81 | ||

| GOOGLE MY BUSINESS | 4 |

Our Personal Investment Strategy in Trine

✰ Diversification is the key: We will take advantage of the relatively low minimum investment and offer opportunities of the platform to distribute our capital in the maximum possible number of projects.

Trine Opinion 2024 – Final Conclusion

“In a market saturated with marketplaces of clone loans, Trine stands out for its focus, its social commitment and its geodiversification, which added to its profitability more than acceptable makes it become a platform to consider as a complement of positive impact For our wallets. “

Advantages of Trine – Strengths

➊ Trine goes beyond economic performance to bring us a triple benefit to our investment: social impact, sustainability and profitability.

➋ The platform, with its wide range of countries available to invest, provides depth and richness to the global geographic diversification of our portfolio.

➌ Company directly supervised by the Swedish FSA

➍ Bonus of 10 euros just for registering and testing the platform.

Weaknesses and aspects to improve

➊ Absence of secondary market to make our investment liquid (at least the loans are amortizable).

Alternatives to Trine Review

More than alternatives, we remind you of a couple of sister pages of Trine as excellent complements for it, all accessible through the search engine or the menu of our website and ALL specialized in positive impact investment: LENDAHAND and AGRIKAAB.

Trine Forum

Do you want to have a space to comment and share your doubts and experiences about this Swedish crowdinvesting platform?… Look no further! Here below we enable the Trine Forum so you can express yourself and ask freely… Write us your comment! 🙂