Rendity is a real estate crowdfunding platform with headquarters in Austria and Germany, regulated by the German Chamber of Industry and Commerce (IHK) specializing in property investment in these two Germanic countries.

It brings an interesting breath of fresh air to a real estate investment crowdfunding market a bit saturated by the Baltic platforms (Estateguru, Crowdestate, Bulkestate, Reinvest24 …) and the Spanish ones (Housers, Brickstarter, Inveslar, …), and although it is not a perfect platform, has an interesting bonus of 25 euros free to those who want to try it.

What is Rendity Statistics and Global Data

Rendity is a crowdfunding company that has been operating since 2015, mainly in the city of Vienna, and which has already brought together more than 1,000 investors who have participated in any of the 20 projects that the platform has published to date with a volume financed that already exceeds 10 million euros.

No doubt they are not bad figures for a company that operates in this sector.

First Steps in Rendity

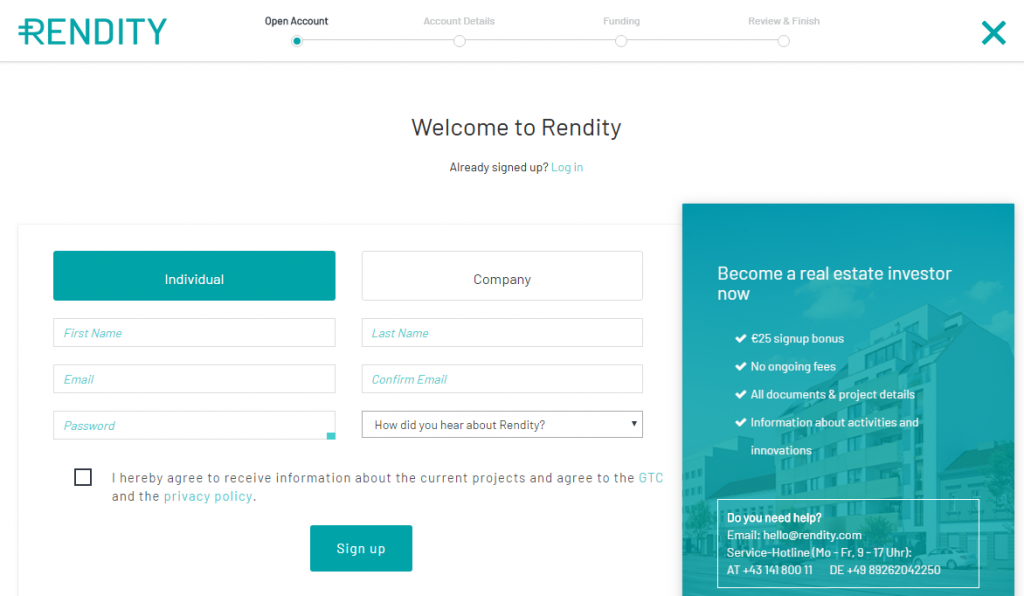

Rendity follows a relatively standard process of registering new users, which will consist of filling out an initial questionnaire, verifying our email address, uploading a receipt of our documentation and making the first contribution of funds to our account. Nothing complicated; In a few minutes we will have everything ready to start investing.

Requirements to create an investor account in Rendity

+ Be of legal age (over 18 years).

+ Registration is open to citizens who have a bank account in Europe. Other nationalities should consult hello@rendity.com first

Steps to Open an Account in Rendity Crowlending

➊ Fill in the initial registration form.

➋ Confirm our email address.

➌ Upload DNI / Passport (identity verification documents) + bank account verification documents.

➍ Make the first transfer by bank deposit or credit card.

Deposits How to add funds to our Rendity account

Rendity supports payments by bank transfer or credit card, the latter option being a very convenient way to add funds and be able to invest instantly. None of these operations has any cost to the investor.

Rendity Recommendation Code – Promotional Code

Currently there are NO promotional codes for Rendity. The promotion of 25 euros free as a welcome gift applies to anyone who registers from the links on this page, and it is NOT necessary to indicate any additional promotional code (the bonus is included in the link).

How Rendity Commissions Work

Rendity is a platform “0,0”, WITHOUT commissions: it does not have commissions of management, maintenance, deposit or withdrawal, with which all the basic functions are free for investors.

How to Invest in Rendity in 2024

Rendity has investment in MANUAL mode from 1,000 euros per operation. It does not have a function of Auto-Invest or secondary market, so we must examine the information provided in each of the operations of the primary market and decide if they adapt to our investment objectives.

Manual Investment Rendity Analysis – Most Important Parameters

Then we will discuss some of the most important parameters that define each of the operations published in Rendity:

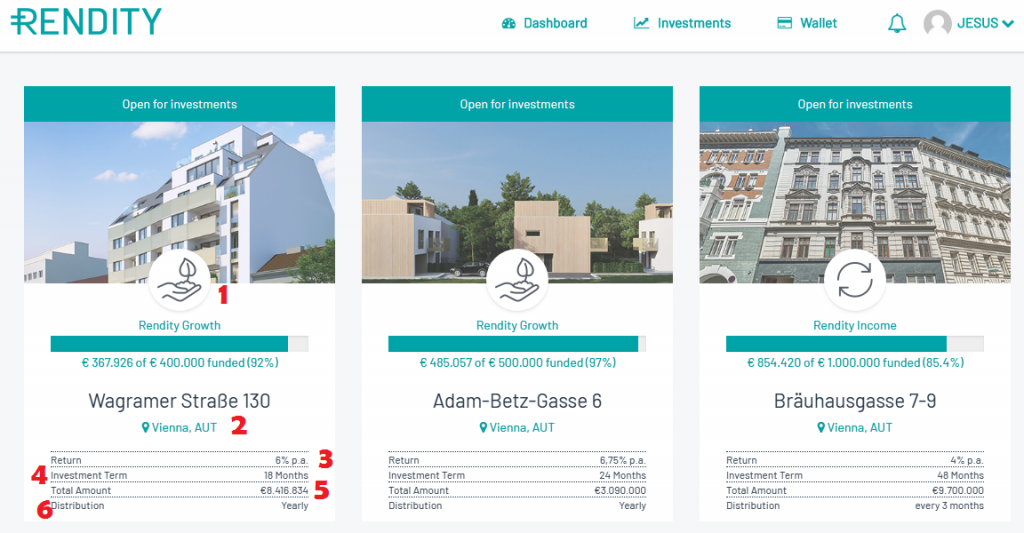

➊ Type of investment

In Rendity we have two basic models of investment: one oriented to profitability and speed, but of higher risk (Rendity Growth) and another oriented to stability and lower risk (Rendity Income). We see more details of these typologies below.

1.1. RENDITY GROWTH

Rendity Growth is an investment model equivalent to the “Fixed Rate” in Housers, specializing in the granting of loans to developers for real estate developments, with greater profitability than the income model and a shorter duration of the operation as a whole, but with distributions of more spaced interests and greater risk than the other type of investment that we find in Rendity.

1.2. RENDITY INCOME

Rendity Income is an investment model equivalent to the “Savings” in Housers, based on the generation of rental income and a longer term investment horizon. It usually presents a longer term than in the Growth model, a lower risk and a more frequent distribution of income.

➋ Location of the Investment

The vast majority of the opportunities and projects that we will see in Rendity are real estate in Vienna (Austria), although from time to time we can see some other Austrian city or even some opportunity in Germany.

➌ Return (Interest Rate)

The performance of the operation in which we are interested in participating, expressed in annual profitability. Growth opportunities are around 6% – 7% and Income’s are between 4% – 5%.

➍ Investment Term (Term of Investment)

Number of months until the conclusion of the operation and the return of the loaned capital. It usually ranges from 12 months in the Growth mode to 48 months in the Income mode.

➎ Total Amount (Total Investment)

Total amount of loan granted to the developer (usually 10 or 20 times the amount requested in the crowdfunding operation, the rest being a bank loan, proof of the viability of the operation).

➏ Distribution (Distribution of Interests)

Frequency with which the project pays interest to its participating investors (it is usually annual in the Growth projects and quarterly in the Income projects).

If we click on any of the available projects, we will access a screen where we can access more details about it (see example below).

➐ Instant Interest (Immediate Interest)

One of the strengths of Rendity is that in all its projects interest starts to accrue from the same day we made the capital contribution (it is not necessary to wait until the financing round is closed for it!).

➑ Risk Classification

In Rendity we have 5 risk classifications for each of the real estate investment projects, ranging from “A” (lower risk) to “E” (higher risk). Growth projects tend to have greater risk and profitability, and vice versa, Income projects tend to present lower profitability, but less risk.

Rendity How Autoinvest Works (Automatic Reversal) – Step by Step Tutorial and Configuration

Rendity does NOT have Automatic Investment. Although it would be an interesting addition, it is not essential either, given that the volume of new projects and offers is manually manageable.

Rendity Secondary Market and Liquidity

Rendity DOES NOT have a Secondary Market in which to sell our shares, so the liquidity of our investments -especially in Income-type investments- will be low. This is a factor that we must take into account when investing in this platform.

Buyback Rendity Buyback

The projects published in Rendity, as in the vast majority of other real estate crowdlending platforms, do NOT have a Buyback Guarantee.

Origins Rendity Crowfunding

Rendity is NOT a loan marketplace in the sense that it does not act as an intermediary for other credit entities -Originers-, but directly puts promoters and investors in contact.

Rendity Crowdlending Cash Withdrawals

Rendity allows you to make quick cash withdrawals from our investment account without cost. In one or two business days we will have our money back in our bank.

Is Rendity GMBH safe? Risks and Regulation

Rendity is a Crowdinvesting company regulated by the German Chamber of Industry and Commerce (IHK) and also registered as a commercial investment manager in Austria.

Like all crowdlending and investment crowdfunding platforms, in addition to offering an attractive return, it presents a series of risks that we must be aware of before investing in it, among which we mention:

Risk of lack of liquidity of the invested capital

The projects in Rendity are medium-long term loans that are made to a real estate developer for the purpose of investment documented in the file of each of the operations, therefore, our capital will be blocked until the end of said loan (usually between 12 and 48 months).

We must consider Rendity as an illiquid investment in the medium-long term and, of course, never invest money that we may need in the short term.

Risk of non-payment of loans by borrowers

The risk that the borrower can not pay interest or repay the loan at the end of the term is one of the risks that the investor in crowdlending must take into account.

In Rendity, this risk is minimized in two ways:

✰ Careful selection of real estate developers as the central axis of the philosophy of the platform’s business model, proposing only the best opportunities for financing.

✰ Financing of operations that are also usually financed by banks, with crowdfunding only being a complement to this financing (this detail can be found in the file of each project).

Risk of collapse of the real estate market

According to Rendity’s own words in its FAQ, an abrupt decrease in the real estate sector has no effect on our collection rights of the investment made. However, they can not guarantee us that a collapse of real estate prices can not have negative effects on the projects listed in Rendity.

Ergonomics Rendity P2P Web and Reports

Rendity is a modern and functional web, very simple to navigate and use, which nevertheless as a negative point, is not yet translated into some languages such as Spanish or Italian.

If we carry out the study that we usually carry out about how many clicks are necessary to perform some of the most basic actions in the platform, we obtain the following results:

★ 5 clicks to invest in one of the loans

★ 3 clicks to see the status of one of the projects in which we have invested

★ 3 clicks to withdraw money

Which is slightly above the average of crowdlending platforms.

Rendity Annual Return Real Expected

✰ Rendity has an average gross return of approximately 6% , depending on the type of opportunity in which we invest.

✰ DOES NOT present any service fee, so you do not lose commission fees.

✰ We are not aware that there has been any failed loan to date – although this is not a guarantee that it can not be in the future -, which usually should not lose profitability due to non-payment.

✰ The estimated annual average net profitability, therefore, is 6% base minus 0% of losses = 6% net annual for a well-diversified portfolio in the long term, which is below other similar crowdlending platforms at present.

Taxation Rendity – Tax Withholding

Rendity DOES NOT practice retentions on the interest charged on the platform. All our profits will be gross, with what we must declare and pay for our benefits in the Annual Income Tax Return (currently 19% up to 6,000 euros).

In case of doubts, consult a tax advisor.

Rendity P2P Lending – Contact Information and Customer Service

We can contact Rendity through the investor attention email hello@rendity.com and by phone at +4314180011 (German and English) during business hours.

In addition, Rendity is a very active crowdfunding platform in social networks, so we can leave you a message via Facebook, Twitter or Linkedin that will be quickly attended by its Customer Service agents.

The Team behind the Company

Lukas Müller, Tobias Leodolter and Paul Brezina are the trio of entrepreneurs and co-founders of this real estate crowdfunding platform, being the Chief Executive Officer, Chief Marketing Officer and Chief Financial Officer respectively.

Is Rendity reliable?

Rendity is a platform not yet well known by the investment community in some countries, but which has been implemented for a long time in the European community, especially the German one due to the proximity and focus of this crowdfunding website.

To date there is no negative experience recorded in opinion aggregators such as TrustPilot.

Our Personal Investment Strategy in Redity

We only offer details of investment strategy in 4 or 5 star platforms.

Opinion Rendity 2024 – Final Conclusion

Rendity is a good platform for real estate crowdfunding fans who want to diversify and invest in something more than Housers and the typical Baltic platforms, given that it gives us access to properties in Germanic countries with interesting projects and abundant information. In addition, its registration bonus of 25 euros is a good incentive to test the platform.

However, factors such as a high minimum investment (1,000 euros per operation) and profitability below the industry average reduce the overall rating and make Rendity more of a kind of Delicatessen that we want to try, but that may not be something that we consume every day.

Advantages of RENDITY GMBH – Strengths

➊ Access to the German real estate market with properties in Austria and Germany, ideal to diversify.

➋ Interest is generated from the first day we invest the money. We do not have to wait for the financing round to end.

➌ Attractive welcome promotion with 25 euros bonus just register.

Weaknesses and Aspects to improve

➊ Profits below the industry average, between 6 – 7% at best.

➋ Minimum investment too high (1,000 euros), which implies high capital needs to diversify.

➌ Absence of a secondary market and low liquidity for our investments.

Alternatives to Rendity Review

As we have said, Rendity is an interesting platform in that it allows us to diversify our real estate portfolio with properties in the Germanic countries, something that we had practically not had occasion to do with any other page to date.

Therefore, it does not have competition in the specific niche to which it subscribes, but we do consider that Estateguru , Crowdestate or Housers are global real estate crowdfunding platforms … If you are still not in these investment websites, it may be a good point of game before you start in Rendity.

Rendity Forum

Do you want to have a space to comment and share your doubts and experiences about this Austrian real estate crowdfunding platform? … Look no further, here below we enable the Rendity Forum so you can express yourself and ask freely … Write us your comment!