In this article we are going to tell you what Bitbond STO is and why we like it and we are going to participate in this investment opportunity which is the first German Security Token that complies with all the European regulations and offered by Bitbond, a crowdlending and P2P lending platform approved and regulated by BaFin (Regulatory Financial Authority in Germany)

What is a Security Token?

If you have come to this page interested in investing in Bitbond STO probably the first thing you are wondering is what is a “Security Token”.

Well, a Security Token is an exchangeable financial asset in the real world (such as a fixed-income bond, the shares of a company, etc.) that has been digitized through blockchain technology and converted into a cryptoactive.

Security Tokens and STOs (Security Token Offerings) are subject to a very strict regulation compared to the ICOs (Initial Coin Offering), and in fact, Bitbond STO is the first STO in Germany that complies 100% with all regulations European in the matter.

What is Bitbond?

Bitbond is a German company authorized by BaFin (equivalent to the CNMV in Spain) created in 2013 and dedicated to the financing of small and medium enterprises through the collective contributions of different investors. It has been operating successfully for more than five years in this market, and in fact it has already been the subject of our review as a crowdlending platform on this same website.

The successful business model of Bitbond is based on the generation of benefits through commissions to borrowers in the granting of each loan and to the lenders at the time of the repayment of their contributions and interest.

What does Bitbond STO offer me?

The Security Token Offering of Bitbond (Bitbond STO) allows us to buy Bitbond Tokens (BB1), some electronic bonds that will entitle us to a series of benefits:

✰ Charge of 1% of fixed quarterly profitability, which means a fixed annual return on bonds of 4%

✰ Annual charge of a variable return (60% of Bitbond’s benefits before taxes)

✰ Repurchase by Bitbond of all BB1 after 10 years at the price of 1 euro per token (which can be a source of additional profitability in case of having purchased the discounted tokens, as we will see later).

How can I buy Bitbond Token (BB1)?

The Bitbond Tokens can be purchased on the official Bitbond STO website at the price of one euro per token. You can pay both by bank transfer and with cryptocurrencies (Bitcoin BTC, Ethereum ETH or Stellar XLM).

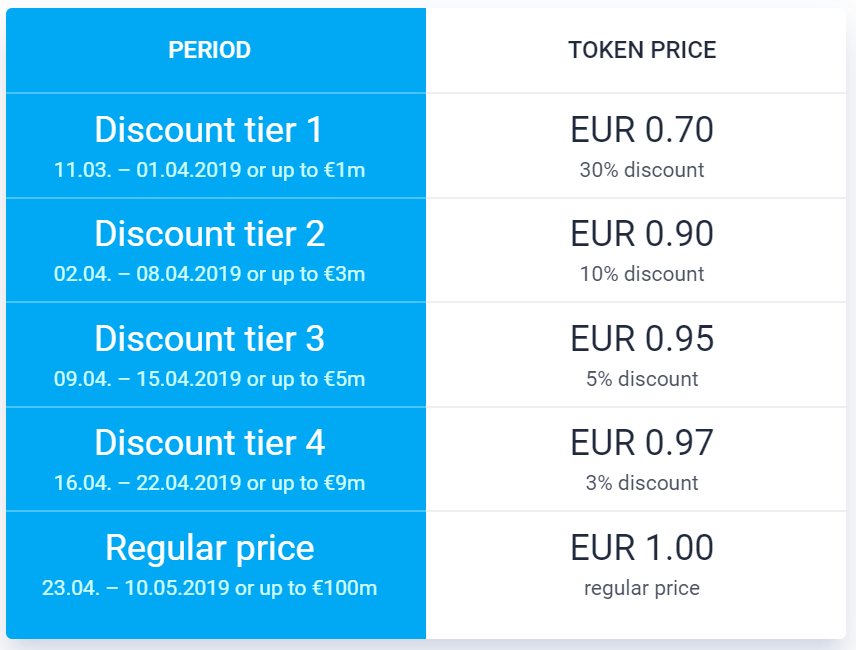

The sale officially starts on March 11 and will end two months later, on May 10.

Case Study Example Bit Bond STO

Let’s see a practical example of the payments and expected calendar for the holders of BB1 tokens.Let’s suppose that we have bought 10,000 Security Tokens in Bitbond STO, and that we have been among the first to acquire them and we have managed to buy them in Tier 1 (30% discount).

✰ MARCH 2019: Initial Purchase Price of 10,000 tokens BB1 = 10,000 * 0.70 = 7,000 euros

✰ MAY – JUNE 2019: End of the Bitbond STO campaign, automatic creation of portfolios and delivery of tokens.

✰ OCTOBER 2019: First coupon / quarterly dividend payment (1%) = 10,000 * 0.01 = 100 euros

✰ JANUARY 2020: Second voucher / quarterly dividend payment (1%) = 10,000 * 0.01 = 100 euros

… (repeated every 3 months) …

✰ EACH YEAR: Delivery of the proportional part of 60% of Bitbond’s pre-tax benefits (variable amount)

… (repeated every year) …

✰ JUNE 2029: Repurchase of the BB1 tokens by Bitbond at the price of 1 euro per unit: additional capital gain of 3,000 euros (10,000 euros of sale – 7,000 euros of purchase).

Is Bitbond STO safe?

As we have said, Bitbond STO is the first Security Token Offering in Germany that fully complies with the European investment regulations, and its issuer, Bitbond is a company founded more than five years ago, with a business consolidated and regulated by BaFin. , equivalent to the CNMV in Spain.

Despite these characteristics, we must always bear in mind that any investment entails risks of capital loss, and this is no exception. We recommend you read carefully the Investment Prospectus in which all risks are listed on the official Bitbond STO website .